5 Types of Adjusting Entries

The department has three basic types of payroll accounting entries Accounting Entries Accounting Entry is a summary of all the business transactions in the accounting books including the debit credit entry. Once youve made the necessary correcting entries its time to make adjusting entries.

Adjusting Entries Definition Types Examples Business Law Financial Statement Adjustable

Option names defined in this specification are always strings single xsstring values.

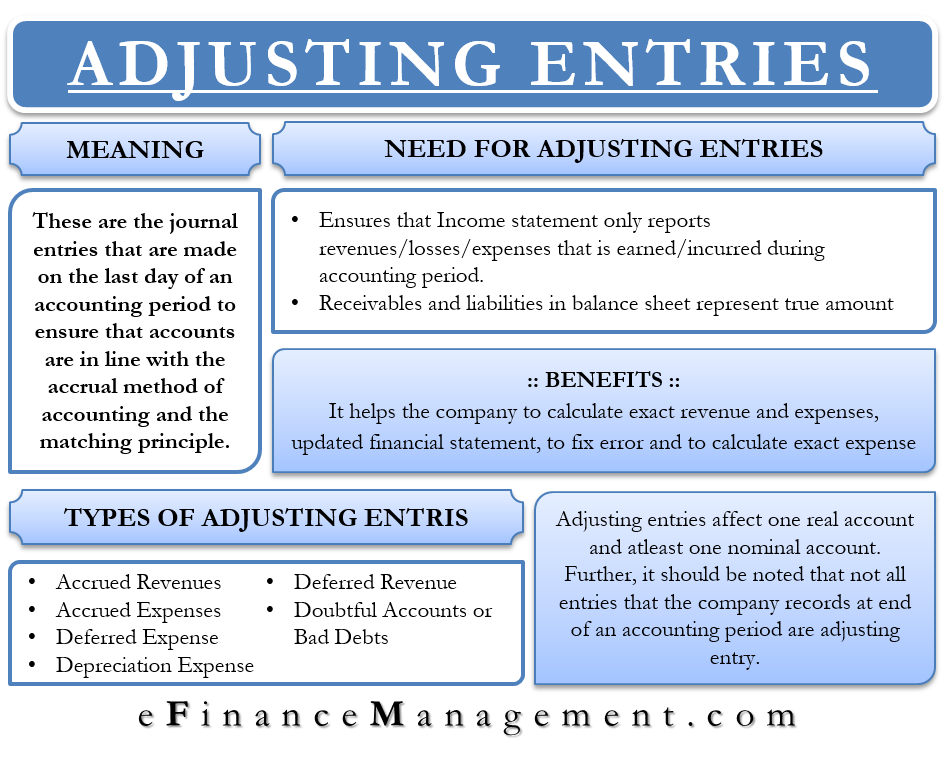

. If making adjusting entries is beginning to sound intimidating dont worrythere are only five types of adjusting entries and the differences between them are clear cut. It has 3 major types ie Transaction Entry Adjusting Entry Closing Entry. A typical example is credit sales.

The entries in the map are referred to as options. Adjusting entries are required at the end of each fiscal period to align the revenues and expenses to the right period in accord with the matching principle in accounting. This entry type is posted to shift ending to retain the earning account from all temporary accounts like loss gain expense and revenue account Revenue Account Revenue accounts are those that report the businesss income and thus have credit balances.

After adjusting the balances as per the bank and as per the books the adjusted amounts should be the same. Once the balances are equal businesses need to prepare journal entries for the adjustments to the balance per books. There are four main types of adjustments.

Although option names are. Illustration of Prepaid Rent. Now that we know the different types of adjusting entries lets check out how they are recorded into the accounting books.

1151 Understanding the Post Process for Journal Entries in a Foreign Currency After you enter review and approve foreign currency journal entries you post them to the general ledger. By March 31 20X1 half of the rental period has lapsed and financial statements are to be. The key of the entry is called the option name and the associated value is the option value.

3 Closing Entry. When goods are sold to. When goods are purchased.

When the cash is received at a later time. When a cheque for 40200 is issued to the petty cashier the entries made in the main cash book are. A main part of the accounting process is payroll and paying your employees correctly needs to be a priority.

The remaining 6000 amount would be transferred to expense over the next two years by preparing similar adjusting entries at the end of 20X2 and 20X3. When reconciling balance sheet accounts consider monthly adjusting entries relating to consolidation. If they are still not equal you will have to repeat the process of reconciliation again.

An accrued revenue is the revenue that has been earned goods or services have been delivered while the cash has neither been received nor recorded. The revenue is recognized through an accrued revenue account and a receivable account. Accounting journal entries log transactions into accounting journal items and use debits abbreviated as Dr and credits abbreviated as Cr to record transactions.

The first journal entry in. Types of Adjusting Journal Entries 1. Journal entries in a perpetual inventory system.

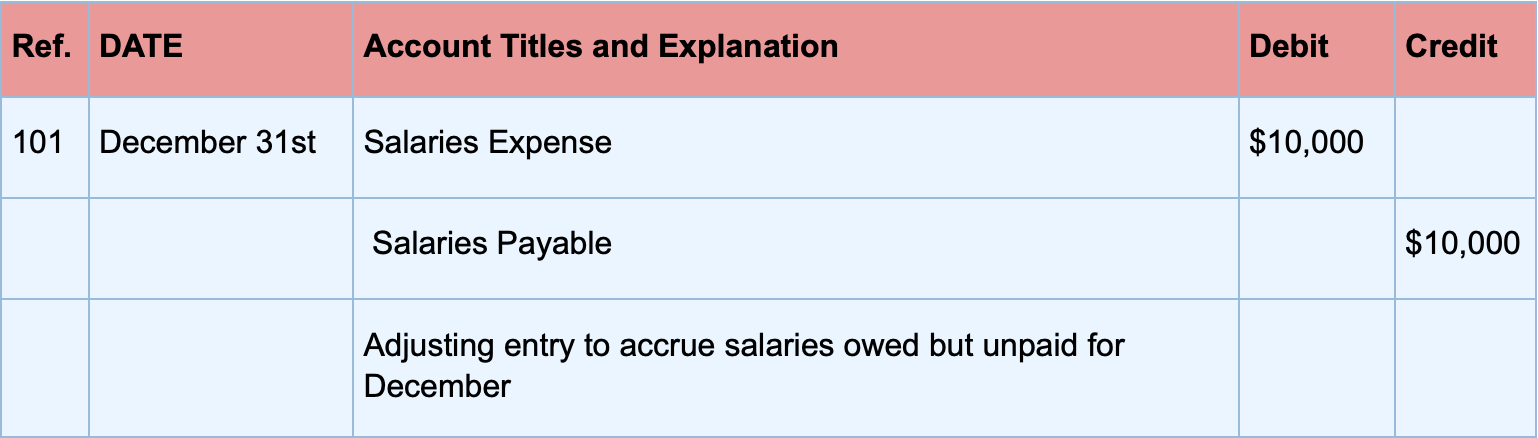

The type of the options parameter in the function signature is always given as map. Adjusting Entries Why Do We Need Adjusting Journal Entries. For the month of December this is the information.

In the ledger the wages account is debited by 11320 the transport account by 4180 the stationery account by 8660 the staff tea account by 2640 and the. When you generate revenue in one accounting. The total 40200 is shown on the credit side of the cash book bank column as payment.

The five types of adjusting entries. Read more which are classified as the initial recordings manual payments and accrued. When goods are returned to supplier.

For the sake of our example Company XYZ adjusts their accounts at the end of every month through the double-entry bookkeeping method. Adjusting entries make sure that your financial statements only contain information relevant to the particular period of time youre interested in. The set of journal entries involved starting from purchase to sale of goods under perpetual inventory system is given below.

When expenses such as freight-in insurance etc. Option values may be of any type. In general there are two types of adjusting journal entries.

Assume a two-month lease is entered and rent paid in advance on March 1 20X1 for 3000. Compensation errors while uncommon with automated tools like QuickBooks do happen. Here are descriptions of each type plus example scenarios and how to make the entries.

5 Examples for Adjusting Entries. Deferrals accruals tax adjustments and missing transaction. Revenue from sales revenue.

The post program selects unposted journal entries from the F0911 table posts them to the F0902 table and then updates the transaction in the F0911 table with the posted code P posted. A closing entry is a journal entry done at the end of the accounting period. Intercompany transactions include adjusting entries for profit elimination relating to general ledger accounts like intercompany revenues accounts receivable fixed assets inventory accounts payable and cost of sales.

Adjusting Entries And Accounting Treatment Journal Entries

What Are Adjusting Entries Definition Types And Examples

Adjusting Entries Meaning Types Importance And More

Adjusting Journal Entries Defined Accounting Play Journal Entries Accounting Accounting Education

No comments for "5 Types of Adjusting Entries"

Post a Comment